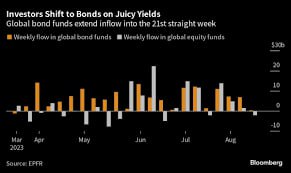

– The current expectation of sustained high global interest rates is driving investors to shift from stocks to bonds.

– Bonds now have a yield premium of 180 basis points over stock dividends, marking the highest margin in 15 years. This gap is expected to persist or even widen as traders speculate that low rates will not be a long-term feature.

– Fidelity International emphasizes that the presence of positive real yields further strengthens the argument for investing in Treasury bonds.

“The Rise of the Debt Market

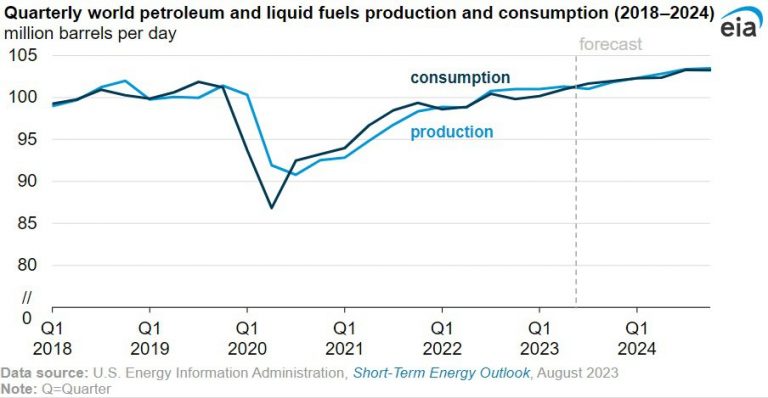

BRICS’ Growing Dominance in Global Oil Production

The inclusion of Saudi Arabia, UAE, and Iran in BRICS means that the union, along with six other major oil-producing nations, now collectively account for 80% of worldwide oil production.

“Historical Peak in Oil Demand Expected in First Half of Next Year”

According to the US Department of Energy, there will be an unprecedented surge in the demand for oil in the first half of the upcoming year. Despite the economic challenges faced by China, high rates in the US, and a recession in Europe, the growth in demand remains unaffected. Additionally, the oil production of major players like Saudi Arabia and Russia is constrained by the economic alliance of OPEC+.

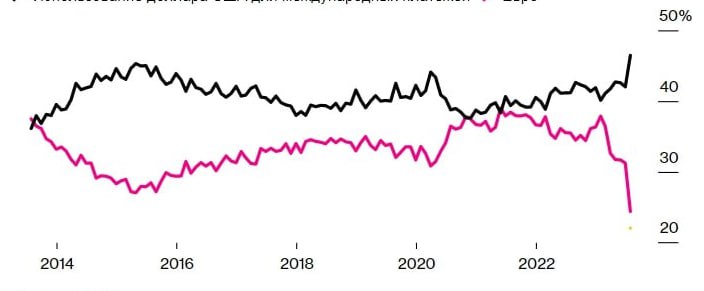

“USD Dominance Surges in International Payments, Euro Plummets to a Historic Low”

In July, the utilization of the US dollar in global transactions reached an unprecedented high, as reported by SWIFT. Approximately 46% of all Swift foreign exchange (FX) transactions were conducted using the dollar. Simultaneously, the euro’s share dwindled to an unprecedented low, while the yuan surpassed 3% for the first time.

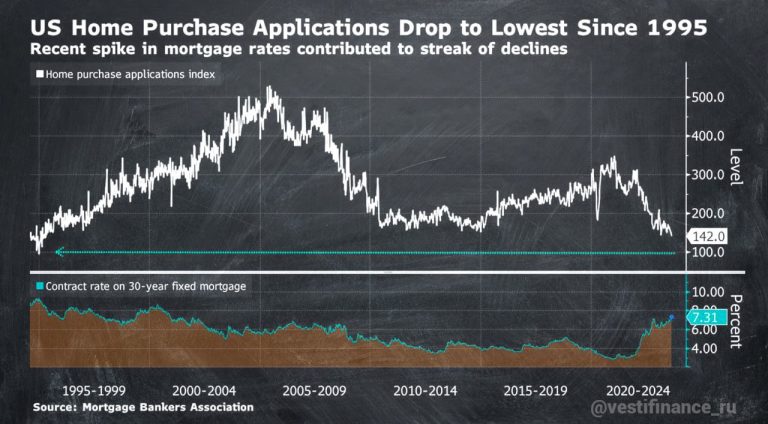

Decline in US Home Filings and Mortgage Applications

– Quote 1: US homes filings reach their lowest level since 1995

– Quote 2: U.S. home mortgage applications hit a nearly 30-year low, driven by increasing loan costs.

– Quote 3: The Mortgage Bankers Association’s Home Application Index drops 5% to 142, hitting its lowest point since 1995. Additionally, the contract rate on 30-year fixed mortgages increased by 15 basis points to 7.31%, the highest since late 2000.

– Quote 4: Refinancing activity decline leads to a 4.2% decrease in overall demand for mortgages. Meanwhile, mortgage prices keep rising, with the 30-year fixed rate estimated to be close to 7.5% by Mortgage News Daily.

Increasing Wage Expectations Signal Potential Inflation Concerns

Job Seekers, including those currently employed, anticipate significantly higher wages in job offers, marking an unprecedented surge in wage expectations since 2014. This notable acceleration in wage expectations reflects a sense of optimism among job seekers, leading to an intensified pursuit of higher wages.

“Euro Weakens Against Dollar as German Economic Data Disappoints”

“The release of disappointing German economic data has led to a sharp rise in the dollar against major currencies, causing concerns about the strength of the European economy and the possibility of future interest rate hikes by ECB. As a result, the euro is expected to undergo a significant devaluation against the dollar, presenting investment opportunities in European assets such as real estate, stocks, and bonds.”

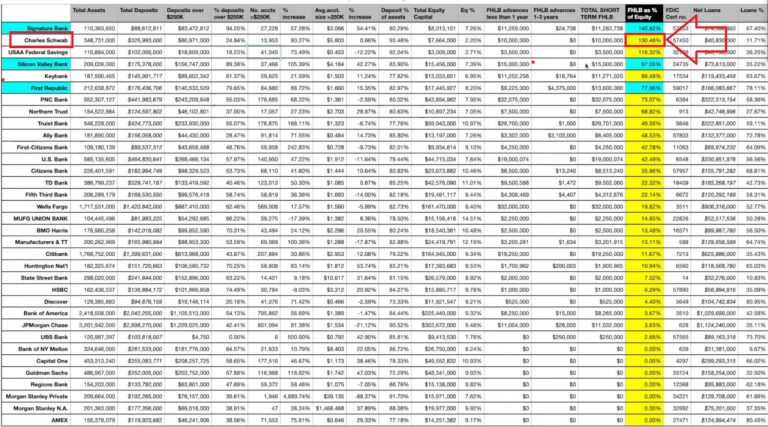

False Rumors Surrounding Truist Bank’s Financial Stability

False rumors about Truist Bank’s financial instability circulate, suggesting potential bankruptcy alongside Charles Schwab and HSBC. Concerns arise regarding a possible recurrence of the Lehman moment in September. However, these rumors are baseless and misleading.

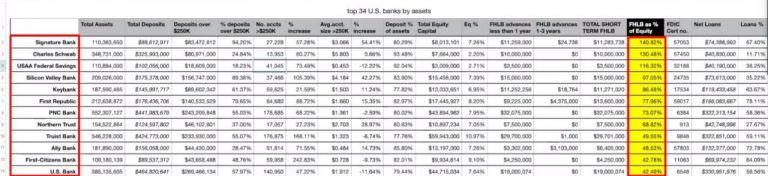

Concerns Rise Over Charles Schwab’s Financial Stability and Potential Collapse

Charles Schwab faces mounting speculation about its financial stability as rumors circulate that it is heavily indebted and potentially facing a collapse similar to the Lehman Brothers and other banks in the past.

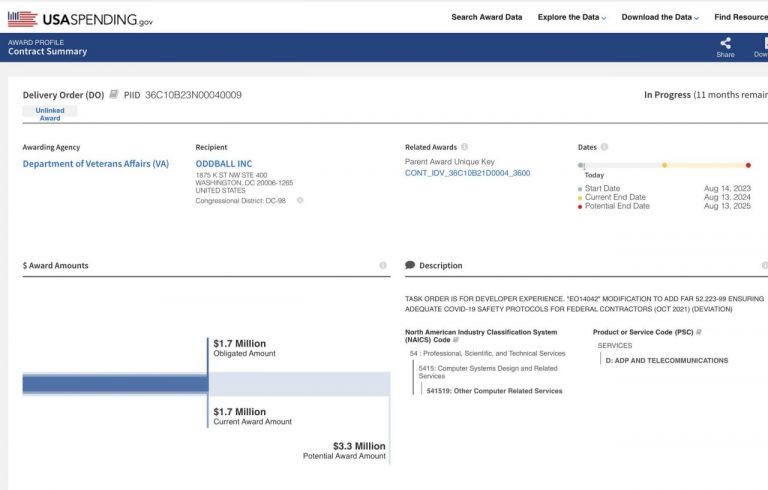

Speculations about the US Government’s COVID-19 Response and Lockdown Measures

– Quote 1: “RUMORS: The federal government has initiated the procurement of COVID-19 supplies and engaged consultants to ensure compliance with safety protocols during the pandemic.”

– Quote 2: “Certain contracts are set to commence in September and October. Are speculations suggesting that Biden will impose a nationwide lockdown? Will there be another round of vaccinations?”